The variable rate mortgage (or VRM) has become more popular in Canada over the past few years. With this mortgage, the interest rate changes whenever the prime rate changes. With the current prime lending rate at 2.25% and lenders offering rates near prime, this has become a product of interest. Variable rate mortgages tend to have lower interest rates than fixed term mortgages and on average can save you money in the long term.

The variable rate mortgage (or VRM) has become more popular in Canada over the past few years. With this mortgage, the interest rate changes whenever the prime rate changes. With the current prime lending rate at 2.25% and lenders offering rates near prime, this has become a product of interest. Variable rate mortgages tend to have lower interest rates than fixed term mortgages and on average can save you money in the long term.

Although adjustable and variable rate mortgages are similar in that they track the prime, they differ on one major point: How changes in rates affect your principal, payments and interest. In an variable rate mortgage, your payments are a constant amount, as opposed to in a adjustable rate mortgage, where your payments vary with the rate. For an variable rate mortgage, the constant payment is accomplished by changing your principle and interest. Because of the unchanging payment amount, variable rate mortgages are far easier to budget around.

Apply for a Variable Rate MortgageTypically, most variable rate mortgage products do have the option of fixed or stable payments, meaning your payment amounts do not change from payment to payment. If mortgage rates go up, a larger portion of the payment is applied to interest. If rates go down, a larger portion of the payment is applied to the principal. If you like to budget your expenses each month, be sure to ask for a VRM with fixed payments.

Keep in mind that in today's competitive market with such a vast number of lenders, it is extremely unlikely that VRM interest rates could hit double digits any time soon.

Frequently asked question: What if prime rate goes up?

History has shown that the prime rate does not usually spike over night. This interest rate is affected by the Canadian economy and the monetary policies set by the Bank of Canada. It typically jumps by only 25 basis points (or a quarter of a per cent) when and if it moves. Sometimes it will not move at all for 12 months. Other times it can move four times in a year.

If the prime rate does increase, most of our variable mortgage rate products allow you to lock into a fixed mortgage rate at any time without penalty. With the help of a mortgage associate you can lock into the current rate and not just the 'bank posted' rate as most conventional banks or lenders will offer. Plus, this can be done by a simple phone call. You do not have to re-apply or re-qualify for a new mortgage.

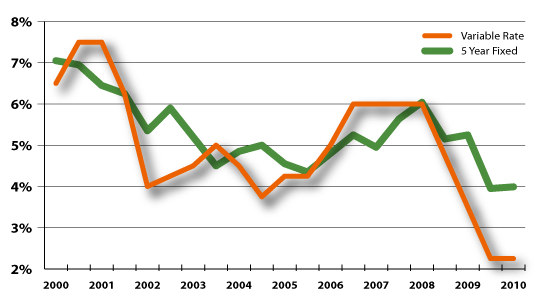

The best way to feel good about choosing a variable rate mortgage is to check out statistics on the history of its movement. You can see that the rate adjusts slow enough so you have time to make a wise, informed decision rather than rushing to lock in when you could keep the lower rate and payment offered by the VRM.

A study by Dr. Milevsky of York University shows that between 1950 to 2007, one in seven Canadians who chose a variable rate mortgage saved an average of $20,630 on interest payments per every $100,000 over a 15 year period. These savings were directly due to the lower interest rate enjoyed through a variable rate mortgage.

The following chart shows how the variable interest rate compares to a 5-year fixed term.

For more information about variable rate mortgages, please visit Super Brokers.

Alberta Equity has helped over 50,000 people find and qualify for the best mortgages in Canada for over ten years. We do all of the heavy lifting and ensure that you get the best mortgage rates and product features available. Apply online for a free, no obligation consultation.

AlbertaEquity.com is managed by Super Brokers Incorporated, a division of TMG The Mortgage Group. Our goal is to help you find the best mortgage rates (OAC) and lenders in and around Calgary, Edmonton, Lethbridge, Medicine Hat and Red Deer. Super Brokers is a proud member of the Better Business Bureau of Southern Alberta. Our mortgage application is secured by Equifax SSL from GeoTrust. Although every attempt is made to ensure accuracy, the information contained here should only be used as a guideline. Please speak to one of our mortgage brokers if you would like more information about our services. For questions or comments about our website, security practices or policies, call our web support line at 1-866-530-5541. To speak with a mortgage broker, call toll free 1-800-604-1864